What to Look for in a High-Limit Business Credit Card

There's often a specific moment when a business suddenly outgrows its credit card, and it usually happens at the worst time, with little or no warning. A vendor payment for that latest order gets declined, a team member can't book travel for a conference, or you're suddenly shuffling expenses across multiple cards just to get through the month.

But many small businesses still rely on the same credit cards with fixed limits that we’ve always used and weren’t really designed for business use. As expenses increase, this often leads to declined transactions, delayed payments, manual approvals, and the need to juggle multiple cards just to cover basic costs. Instead of supporting growth, the card becomes a frustration or a bottleneck in operations.

High-limit business credit cards are designed to solve this issue. They offer greater spending capacity, greater flexibility, and better visibility into where money is going. For growing companies, choosing the right high-limit card isn’t just about accessing more credit—it’s about improving cash flow, reducing friction, and keeping operations running smoothly as the business scales.

What “High-Limit” Really Means for Businesses?

A high-limit business credit card gives you enough spending capacity to handle your actual expenses without constant workarounds. It's not about having an impressive credit limit - it's about having room to operate without thinking about your card every time you need to make a purchase.

Unlike traditional business credit cards with fixed limits, high-limit business credit cards are designed to adjust as your spending increases. Many credit card companies consider factors such as cash flow, revenue, and payment history to determine how much a business can spend, rather than relying solely on personal credit scores.

For businesses, this means fewer declined transactions, easier payment of large or recurring expenses, and less time spent requesting limit increases.

How Credit Limits Impact Cash Flow and Operational Flexibility

Credit limits play a direct role in how smoothly a business operates. When limits are too low, even profitable companies can face short-term cash flow pressure and operational delays. A high-limit business credit card helps remove these obstacles by giving businesses more room to manage expenses without interruptions.

Here are a few ways higher credit limits can improve day-to-day operations:

Having a higher credit limit changes how smoothly you can operate. You stop worrying about whether a vendor payment will go through or if you'll have enough room left on the card for an unexpected expense. Large invoices, software renewals, and travel bookings happen when they need to, not when your credit limit allows.

It also helps with cash flow. You can cover expenses as they come up and pay the card when it makes sense for your budget, instead of scrambling to pay everything immediately just to free up your limit for the next round of bills.

Your vendor relationships get easier, too. When you have reliable credit access, you're not asking for payment extensions or delayed invoices because you've hit your card limit. Payments go through on time, which matters when you're trying to maintain good working relationships.

And when things get busy - whether it's a seasonal spike, an expansion phase, or just an expensive month you didn't see coming - you have room to handle it without panic or workarounds.

The right credit limit isn't about spending more. It's about running your business or nonprofit without your card creating problems you shouldn't have to solve.

5 Key Features to Evaluate in a High-Limit Business Credit Card

Before selecting a high-limit business credit card, businesses should carefully review the features that affect flexibility, control, and day-to-day operations.

1. Credit Limits and Scalability

The first thing to understand is how the credit limit actually works and whether it can grow with you. Most traditional business credit cards set a limit and leave it there, even as your expenses climb. That works fine until it doesn't - usually right when you're trying to pay a large vendor invoice or cover payroll for a bigger team. (Note here: nonprofits may likely need to consult with their board or finance committee members on credit card accounts.)

High-limit cards take a different approach. Instead of locking you into a fixed number, they look at things like your cash flow, how you've been spending, and your payment history. If your business is growing and your expenses are increasing, your limit can adjust to match. You're not stuck filing limit increase requests every few months just to keep up with normal operations.

2. Expense Management Built Into the Card

A high-limit card that just gives you more spending capacity without helping you track it isn't actually solving the problem. As your expenses grow, you need to know where the money is going and who's spending it. Otherwise, you're just moving the chaos from "not enough credit" to "too many transactions to keep track of."

Look for cards that include real-time tracking, automatic categorization, and an easy way to capture receipts. When transactions appear immediately and are automatically sorted, you can see what's happening across your team or departments without waiting until month-end to piece it together. You're not chasing people down for receipts or spending hours reconciling spreadsheets - you can actually see your spending as it happens.

3. Global and Multi-Currency Support

As businesses grow and operations expand, spending can sometimes extend beyond a single country. Vendor payments, travel costs, and remote teams require a business credit card that works globally. Many traditional cards offer limited international support or charge high foreign transaction fees.

A good high-limit card should work internationally without making you jump through hoops. If you're paying vendors in other countries, booking international travel, or managing expenses across borders, you need a card that handles multiple currencies and actually gets accepted where you need to use it. The alternative is juggling different cards or payment methods depending on where the expense is coming from, which defeats the purpose of having one system that works.

4. Approval Criteria Beyond Personal Credit

Many traditional business credit cards rely heavily on the founder’s or owner’s personal credit score. While this may work for small purchases, it often limits access to higher credit limits as the business grows. This can be frustrating for companies or nonprofits with strong revenue but limited personal credit history.

Modern high-limit business credit cards use a different approach. Instead of focusing solely on personal credit, they evaluate the business's financial health. Factors such as cash flow, revenue trends, and spending behavior play a larger role in determining approval and credit limits. This makes business credit cards that don't depend on personal credit more accessible to startups and fast-growing companies.

5. Controls, Policies, and Risk Management

As spending increases, businesses need more control—not less. A high-limit business credit card should enable companies to manage risk without slowing down teams. Without clear controls, higher credit limits can lead to overspending, policy violations, or delayed financial reviews.

Built-in controls, such as limits by employee, department, or category, help keep spending aligned with company policies. Approval workflows and real-time alerts make it easier to manage larger purchases and identify unusual activity early. Clear audit trails also support compliance and reporting.

Who Actually Needs a High-Limit Business Credit Card

High-limit business credit cards aren't just for large enterprises. They're built for any organization that handles significant monthly spending and can't afford to deal with declined transactions or constant approval delays.

Growing startups and scale-ups often hit their credit limits faster than expected as software subscriptions, marketing campaigns, and vendor costs add up. The same thing happens with established nonprofits running multiple programs - when you're managing event costs, program supplies, and vendor payments across different departments, a standard credit limit stops working.

Organizations with recurring operating expenses see the most immediate benefit. If you're paying for SaaS tools, cloud infrastructure, advertising campaigns, or logistics every month, you need reliable credit access that doesn't require you to plan around your card limit.

Companies and nonprofits with multiple employees or departments need the extra capacity, too. When you're issuing cards to team members and program managers, you need both the spending room and the controls to track where money is going without micromanaging every purchase.

International work adds another layer of complexity. Whether you're a business supporting remote teams across time zones or a nonprofit with partners in multiple countries, cross-border payments and currency conversions can eat up your available credit quickly.

For finance teams trying to reduce manual tracking and improve oversight, a high-limit card with built-in expense management tools means less time reconciling receipts and more visibility into spending patterns across the organization.

Comparing High-Limit Business Cards to Traditional Options

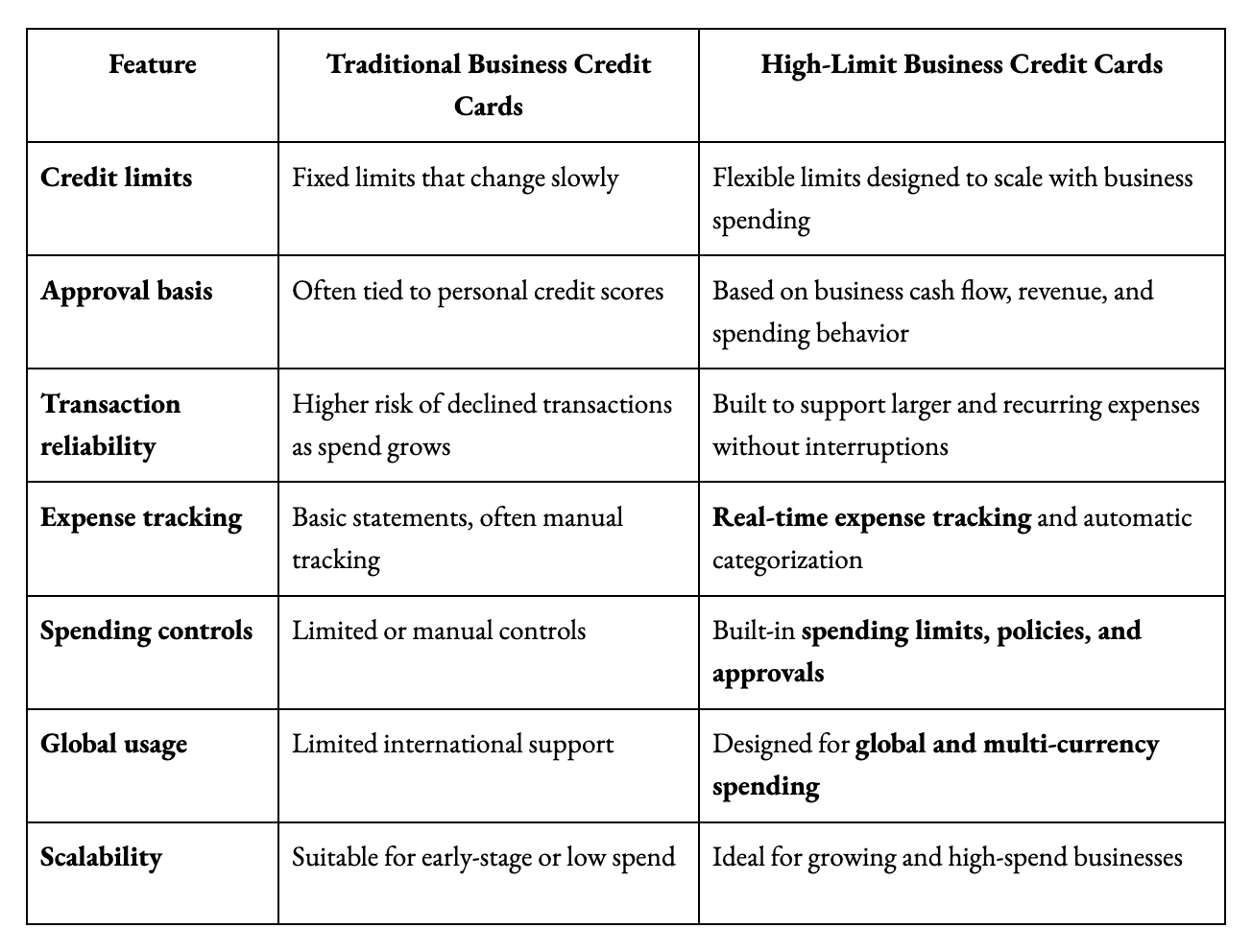

The comparison below highlights how high-limit business credit cards differ from traditional options across key features that matter for growing businesses.

How Brex Can Simplify High-Limit Business Spending

Brex is one option worth considering if you're dealing with rising expenses. The real challenge at this stage isn't just getting access to more credit - it's keeping everything organized and avoiding the delays that come with hitting your limit at the wrong time. Brex addresses this by combining higher spending capacity with expense management tools on a single platform, which can make day-to-day logistics easier to manage.

Brex offers credit limits starting at $100,000 and increasing based on your company's financials. Instead of setting a fixed limit upfront, they consider factors like your cash position and spending patterns, so your limit can adjust as your business changes. This approach helps avoid those frustrating declined transactions when you're trying to cover larger or recurring expenses.

What makes Brex different from a traditional card is that expense tracking and controls are built into the same platform. You can see transactions as they happen, which makes it easier to monitor spending and close your books without jumping between multiple tools or chasing down receipts. For teams that move fast and need to stay on top of expenses without adding extra administrative work, having everything in one place can make a real difference.

Another important feature is advanced spending controls and automation. Businesses can set limits by employee, role, department, or category, helping enforce spending policies without slowing down daily operations. Automated rules and approvals reduce manual oversight while still maintaining accountability, which is critical when managing high-limit business spending at scale.

If you're working across borders, Brex handles international payments and multi-currency expenses in the same system, which is helpful when you have team members or vendors in different countries. It reduces some of the usual friction associated with global spending.

The combination of higher credit limits, expense tracking, and international support means you're not just getting more spending capacity - you're getting tools that actually help you manage that spending as your business or nonprofit grows. It's designed to scale with you rather than become something you have to work around.

Final Thoughts

If you're running a growing business or nonprofit and find yourself constantly working around your credit card instead of just using it, that's a sign you've outgrown what you have. A high-limit card won't solve every financial challenge, but it can remove much of the unnecessary friction from your day-to-day operations.

The key is finding one that actually fits how you work - whether that means handling multiple programs and departments, supporting a distributed team, or just having enough room to pay your vendors on time without playing credit limit Tetris every month. Look for flexibility, built-in controls, and tools that reduce administrative work rather than add to it.